Commercial Real Estate (CRE): 1031 exchanges are historically an important component of the commercial and investment real estate world. A 1031 exchange buyer refers to an individual or entity participating in a real estate transaction under Section 1031 of the Internal Revenue Code, which allows for the deferral of capital gains tax by reinvesting proceeds from the sale of one property into a similar property. The party doing the exchange must reinvest the proceeds and replace the outstanding loan balance. This is the hook - most property owners who have outstanding debt on properties have lower interest rates than what they can get on a new loan today.

By way of example, a $1,000,000 loan (30-year amortization) with a 4% interest rate will have a monthly payment of $4,490, whereas an 8% interest rate will generate monthly payments of $7,337. This is a gross oversimplification, but it gets the point across.

The main issue is that most commercial loans have a Debt Service Coverage Ratio (DSCR). The debt service coverage ratio is a financial metric to assess a property's ability to cover debt obligations. It is calculated by dividing its net operating income by its total debt service payments. 1.2x is a common DSCR requirement, so the 4% loan would require $5,388 of Net Operating Income (NOI or income after all operating expenses are paid), whereas the 8% interest rate would require $8,804 of NOI.

Considering cap rates (a percentage used in real estate to indicate the potential return on an investment property, calculated by dividing the property's net operating income by its current market value) are generally below the interest rate in Southern California, we have negative leverage.

Let's wrap up this example and assume a property sells for $2m with a loan of $1m. The buyer must purchase at least $2m worth of real estate. Using the loan assumptions above with a 4% interest rate, the buyer can purchase a property at a 3.2% cap rate, which is pretty manageable, and at an 8% interest rate, a buyer would need to buy at a 5.3% cap rate.

$5,388 (monthly required NOI*12)= $64,656/$2,000,000 = 3.5%

$8,804 (monthly required NOI*12)= $105,652/$2,000,000 = 5.3%

It's likely with the higher interest rate and (in California, think Prop 13) higher property taxes, this new purchase would be a net negative for an exchange buyer. This is the same phenomenon limiting inventory in the single-family home market, but in that scenario, we are considering move-up buyers instead.

What's The Good Word: California plans to offer financial incentives to homeowners for constructing accessory dwelling units (ADUs), also known as backyard housing. The state budget, signed by Governor Gavin Newsom, allocates $50 million for this purpose. This initiative aims to address the housing shortage in California by encouraging more ADU construction. In the past, a similar program with a $100 million budget led to grants of up to $40,000 for homeowners to build additional housing units on their properties. The current program's guidelines are yet to be finalized, and the distribution process is being determined by the California Housing Finance Agency (CalHFA). While ADUs have potential benefits, they have been primarily constructed in wealthier areas due to high construction costs and limited financing options. To promote more widespread ADU development, experts suggest increasing the grant amount to cover costs for homeowners with limited financing options.

Below is an ADU we built in Costa Mesa.

Macro Observations: Last Friday, Jerome Powell's speech at the Economic Policy Symposium in Jackson Hole indicated that the Federal Reserve will "proceed carefully" with future rate increases. The CME's (Chicago Mercantile Exchange) FedWatch tool showed a 57% chance for a rate hike in November vs. 36.1% the week prior.

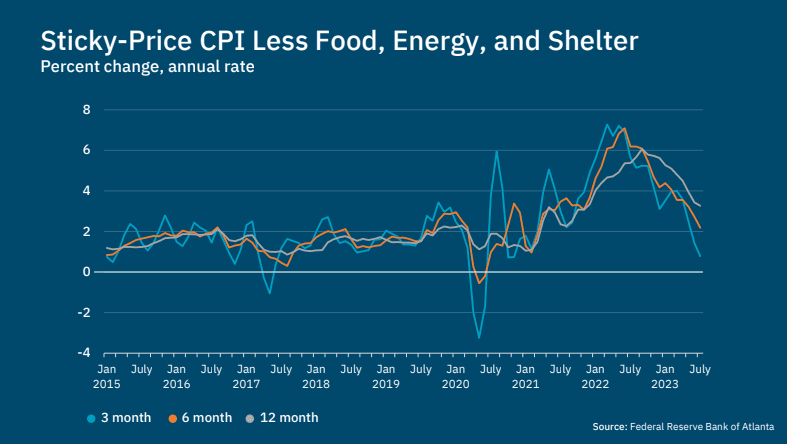

57% by no means a November rate hike is a forgone conclusion, Atlanta Fed President Bostic said if "not for stubborn (and lagging) housing services prices, the core CPI would be running at 2.6% on a year-over-year basis", which some argue is leading to an over estimate of actual inflation, as these numbers continue to work through the system, we should see CPI continue to trend down.

While we are still debating whether or not the Fed will raise rates again this year, Goldman Sachs is already projecting a 25 basis point reduction in Q22024.

Project Updates: We have several ongoing projects; here is a quick update on one.

Mission St, Costa Mesa: Construction is cruising on the two ADUs that we are adding to an existing 4-plex - Thanks to the foresight and some hustle from our general contractor, we were able to get the project "dried in" before "Hurricane" Hillary gave us any problems.

One the interior, we have nearly completed MEPs (Mechanical, Electrical and Plumbing - on our project there technically isn't any mechanical because we are not doing a central AC). The two photos below show our status on electrical, fire sprinklers and plumbing. Typically, this part of the project feels like it is going pretty slowly to the untrained eye. Once all of the MEPs are complete, we will come take a 3D tour of the property, so we will know the location of all the internal components in the event we have an issue in the future.

Once we get sign-off from the City on the MEPs, the building comes together relatively quickly and begins to resemble a place where people can live.