It is important to remember that US residential housing is the largest asset class in the world, and real estate assets perform very differently based on product type, location, and price point.

Here are the characteristics of markets and communities that I anticipate to underperform the broader housing market:

1. Large concentration of AIRBNB (or vacation homes)

2. Zoom towns - WFH trends are reversing as the tech labor market softens, tech workers who propped up these markets will return to major job centers. The reality is, Austin isn't really a tech hub.

3. High HOA/High Mello Roos Neighborhoods

4. Areas with lots of brand-spankin' new homes - new home buyers by virtue of being new home buyers, tend to have less built-up equity (think about parts of the Inland Empire where you drive for miles on end and see new home community after new home community)

5. Areas with a high percentage of FHA (or lower down payment purchasers). Ladera Ranch was the poster child for this in Orange County last cycle

I believe the Orange County, San Diego County, and parts of Los Angeles County housing markets will outperform the broader market with a diverse economy, good schools, and an overall very high level of desirability.

Monitoring inventory from here will be worthwhile to see if it begins to stack up.

Residential Leasing Market: Leasing slowed down considerably this last month, especially in higher price point homes. Part of this might be due to seasonality (families with children prefer not to move during the school year; see graph below rents typically go down a little in September).

We are advising our clients, especially for single-family homes, to cut prices early. Once we hit Halloween, leasing velocity falls off a cliff until the Super Bowl.

To put this in perspective - one such property was leased out until recently at $4,500 - the owner saw Zillow suggested a rate of $5,700; we have now cut the rent to $4,999, which is still +10% over the previous rent. A big part of the story is that homeowners' and rental property owners' pricing expectations have kept increasing as the market is trending closer to reality.

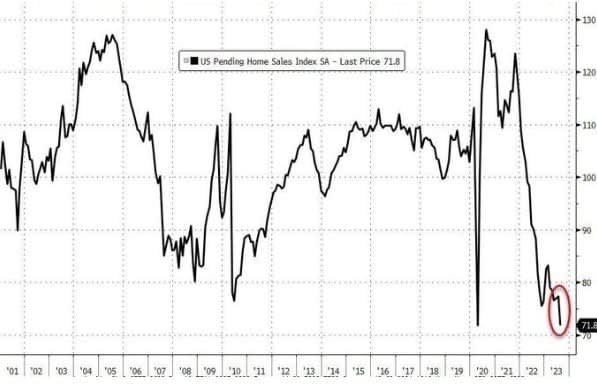

Mortgage Rates/Market: The Federal Reserve has recently hinted at a potential rate increase by 0.25 basis points (BP) in the coming months, with the decision expected to be made in either November or December. This shift in monetary policy comes as the Fed revises its projections for 2024, changing its earlier forecast of a 100 BP rate cut to a more conservative 50 BP reduction. These changes occur against the backdrop of the current financial landscape, where interest rates are at their highest in two decades. This rate surge has significantly impacted the housing market, with home affordability plunging to a 40-year low. This strain on the real estate sector is further evidenced by the fact that new mortgage applications have dropped to levels not seen in 28 years. Interestingly, non-QM rates are almost on par with conventional products.

Commercial Real Estate (CRE): We have discussed how dire the office market has been and will continue to worsen before it gets better. We are often asked, if there is a lot of vacancy in well-located offices and we have a housing shortage, why don't we convert office to residential?

There are a few physical constraints that make it very challenging, with the main issues being:

Land Use and Local Ordinances: Specific local regulations and zoning laws are often in place to determine the allowable uses of properties in different areas. Transitioning an office to a residential space may necessitate navigating through a maze of bureaucratic processes to rezone the property or secure special permissions.

Architectural Configuration: Offices generally have limited window-to-floor plate ratios. This creates several significant issues. First, all habitable rooms require operable windows for egress during the case of an emergency, meaning that all rooms must be along the outer window line, pushing the kitchen and living space deeper into the floor plate.

Mechanical and Plumbing: Offices might not have the necessary plumbing systems to support adding full bathrooms or kitchens. This could mean significant overhauls, from expanding water supply lines to incorporating drainage systems. Similarly, the electrical grid of an office, set up primarily for computers and office equipment, may need enhancements to support household appliances and potentially increased power loads.

Because of the reasons above, very few office buildings can be easily converted to residential use, meaning even with the work-from-home trend reversing, the office market recovery will be slow for 2nd tier properties and locations.

What's The Good Word: Jeff Weniger of Wisdomtree created this graph comparing home inventory to population. Our housing inventory is clearly well below the trendline and WAY below the inventory levels we saw leading up to the Global Financial Crisis (GFC).

This is to say that even if housing inventory increases nationally, we have a housing shortage that will put a floor under home prices. While high interest rates might lead to some decreases in home prices, it will not likely resemble anything close to a crash.

Another factor supporting home prices is that the average Loan-to-value of US housing has trended down significantly since the GFC. The current loan-to-value on the US housing market on the aggregate is close to 29%; in 2008, the loan-to-value was north of 50%. For asset prices to decline significantly, there needs to be distress, homeowners on average have a lot of equity to insulate them from distress.

While total nominal mortgage amounts might have increased this cycle, home values have grown faster than the aggregate mortgage balance for US homeowners.

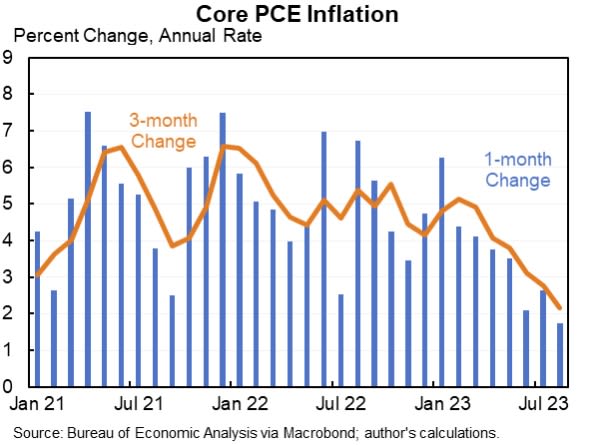

Macro Observations: Besides demographics, one of the reasons I strongly believe that rates will be lower in the future is that the percentage of the federal budget now dedicated to servicing our debt has ballooned. Two primary ways to lower the debt service on our government's outstanding loan balance are: 1) pay down the debt (probably not happening) or 2) lower interest rates.

As of writing this our national debt is an astounding $33..1T, and next our annual interest payments are expected to exceed $1T.

Project Updates: Our active project list is starting to dwindle, so our updates will be limited to a few projects with meaningful activity during the given month.

Mission St, Costa Mesa: Last month, I said we would start flying along once we passed our MEP inspections - well, we decided to do a little value engineering with the HVAC (we decided to remove a mini split and add electric wall heaters), that small change triggered several week delays as it through off our Title 24 Calculation. Title 24 is a set of energy efficiency standards that California maintains. These standards aim to ensure that existing and new buildings can achieve a certain level of efficiency. We decided to go with electric wall heaters, as all new units in California require solar panels, which would allow the tenants to have a very low gas bill.

While we were waiting to sort out the Title 24 issues and get the heaters installed, we were able to make progress on our underground utilities. Below are some photos of the trench we had to dig to tie the sewer line for our new units into the existing sewer line.